Stamp Duty And Registration Charges In Kalyan

Established in 1980 we are one of the most distinguished and admired builders developers in Kalyan Thane Mumbai city that stands firm to upkeep our tradition of providing the best houses to our customers. How to calculate stamp duty and registration charges in Thane.

Stamp Duty Registration For Buying A Home Vakilsearch

So for a house which is valued at Rs 50 lakh you would need to pay Rs 50000 as registration charges.

Stamp duty and registration charges in kalyan. From 01102009 rate of TDS on taxi charges as rent also reduced to 2 only so from 01102009 in both the sections rate are same However us 194C if payment is made to HUF or Individual then TDS rate is 1. Waives stamp duty on transfer of land or flat immovable property to Kin or family members. For a seller this means lower capital gains tax.

These charges can be avoided by transferring property title through a general power of attorney. Stamp duty charges in Maharashtra. 99acres shares the current stamp duty and registration charges in Mumbai.

Payment of stamp duty assures that a transaction is. For some banks apart from the loan agreement the undertaking needs to be registered and the government levies a stamp duty towards registration charges. He announced that now immovable property such as land house or flat.

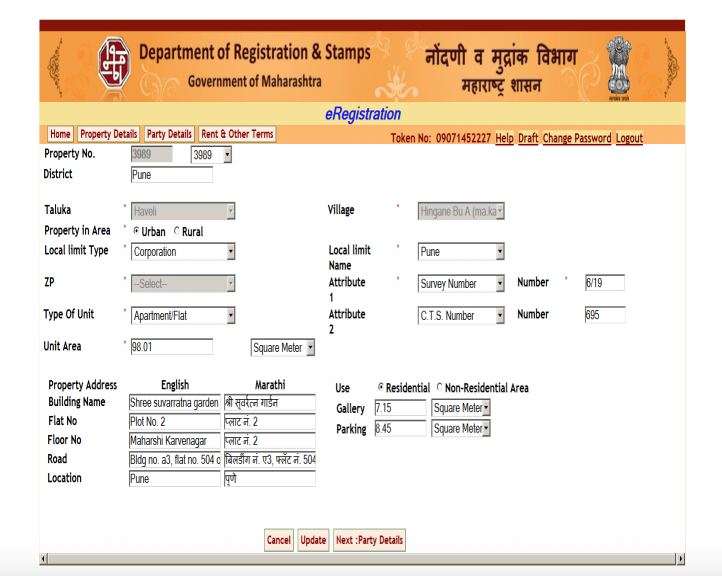

This includes whether the property is located in urban or rural areas total cost of the transaction etc. As per a report in July 2020 the Tamil Nadu Government is likely to reduce stamp duty and registration charges for all rental agreements of more than 12 months. In Mumbai stamp duty is levied under the Maharashtra Stamp Duty Act.

However if a property Residential or Agricultural is gifted without the family having to pay any sum of money. Stamp duty charges vary from one state to the other but on an average charges of 01 percent to 02 percent of the Home Loan amount apply. A company that needs no introduction in the real estate vertical.

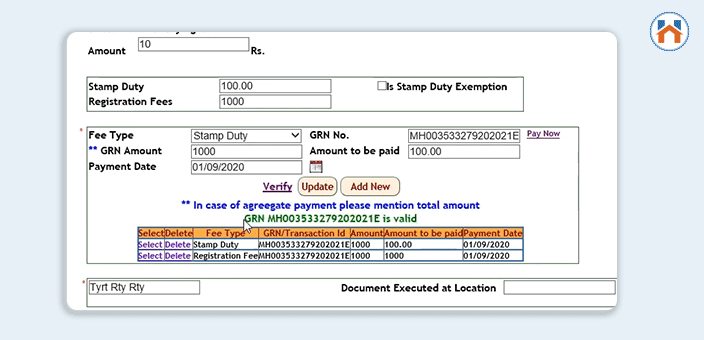

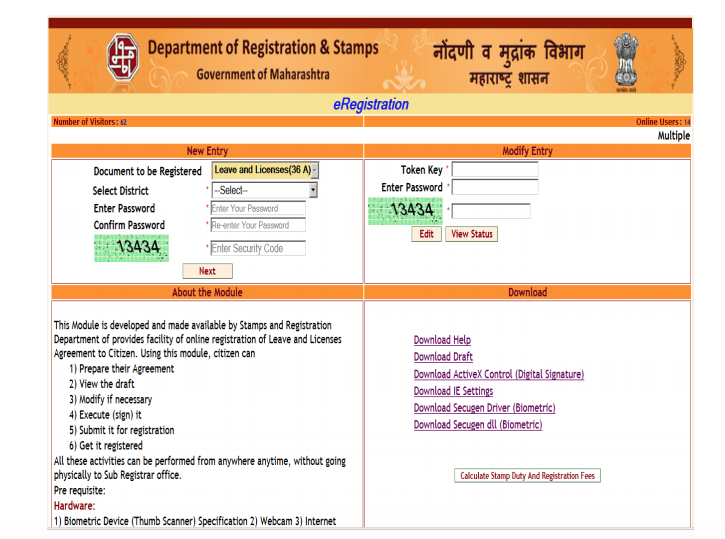

The total amount will be intimated to concerned parties well in advance at the time of initiation of this whole process. The Stamp Duty and Registration Fee are calculated and purchased in the names of the Parties the licensor and the licensee and later on submitted for Registrar approval. Transaction charges STTCTT stamp duty and any other regulatorystatutory charges will be levied in normal course for all trades.

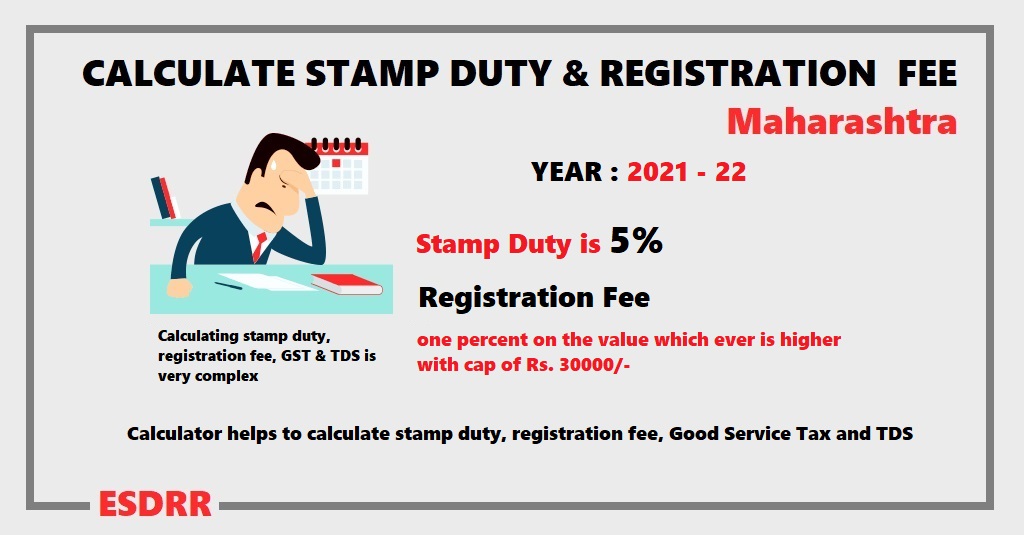

If you purchased a property worth Rs 50 lakh then following will be the breakup of the stamp duty rates and registration charges in Thane - Stamp duty 5 percent - Rs 25 lakh LBT 1 percent - Rs 50000 Registration charges - Rs 30000. It is one of the pre-conditions set forth by the World Bank to fund the Tamil Nadu Housing Sector Strengthening Programme. The registration charges are over and.

Statutory Regulatory Charges. On top of that the seller will have to pay capital gains tax on the transaction. Earlier in April 2020 the Maharashtra government has reduced stamp duty on properties for the next two years in the.

Provided that where an Agreement to sell immovable property on which stamp duty is paid under Article 25 of the Schedule I is presented for registration under the provisions of the Registration Act 1908 and if the seller refuses to deliver possession of the immovable property which is the subject matter of such agreement the application. The total amount payable will be Rs 33 lakh. 90 road-funding car tenure up to 10 years.

Stamp Duty Charges in Maharashtra on Conveyance Deed. Fort Branch Nodal Branch 0222266394722650778. 16 Stamp Duty Registration Fees Transfer Tax-If you decide to purchase property than in addition to cost paid to seller.

Pawan Kalyan recently bought a 676-yard bungalow in Hyderabads posh Jubilee Hills area recently for Rs 12 crore. Kalyan the younger brother of actor-politician Chiranjeevi paid a stamp duty of Rs 66 lakh transfer duty of Rs 18 lakh registration fee. For intraday square off order no brokerage on the second leg will be charged if such trade results in a loss however brokerage on.

All applicable charges on account of Stamp Duty MOD MOE Central Registry of Securitisation Asset Reconstruction and Security Interest of India CERSAI or such other statutory regulatory bodies and applicable taxes shall be borne and paid or refunded as the case may be solely by the customer. According to the amendments made to the Maharashtra Stamp Act 2015 Article 34 states that 3 of the propertys value is the stamp duty on conveyance deeds gift deeds. Branch Code Branch Name Contact No.

To transfer property titles a sale deed must be completed after which the buyer must pay stamp duty and registration fees. The Maharashtra government has reinstated stamp duty rates for property registrations at five percent in Mumbai and six percent in the rest of the State wef April 1 2021. Ranade Road Branch 02224222885 24306207 24228443.

This is required for preparing legal document of property. Buyers can benefit because it means relatively cheaper property and less stamp duty and registration charges. That cost include registration fees stamp duty and transfer tax.

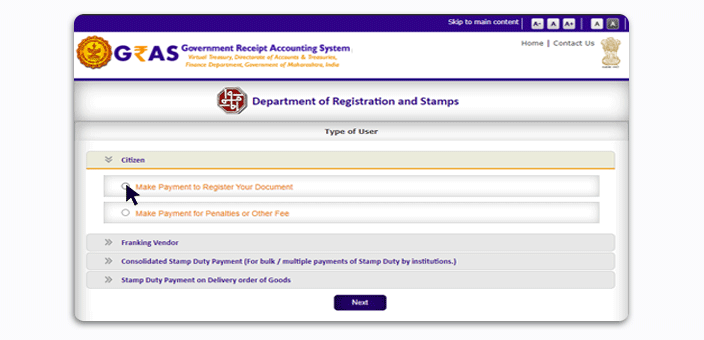

Chiranjeevi paid a stamp duty of Rs 66 lakh transfer duty of Rs 18 lakh registration fee of Rs 6 lakh and mutation charges of Rs 12 lakh as per reports. Pay stamp duty registration and court fees electronically. Pawan Kalyans new house is near to his current house at Jubilee HillsPawan according to sources shelled out Rs 66 lakhs as a stamp duty Rs 18 lakhs for transfer duty and Rs 6 lakhs for registration and mutation charges worth Rs 12 lakh for the property which was registered in the last week of September.

HRBR Layout Kalyan Nagar Bangalore 560043 Telephone. WAIVES STAMP DUTY ON TRANSFER OF LAND FLAT TO KIN or FAMILY MEMBERS Honble Revenu Minister Eknath Khadase announced in Assembly on 25-03--2015 that Govt. Statutory Regulatory Charges.

You must consider additional cost to transfer that property on your name. Stamp duty rates on property depend upon several criteria across Maharashtra state. 1961 says that if stamp duty value exceeds the purchase consideration then the difference between the stamp.

Paperless holding prevents mutilation of certificates through natural or manmade calamities theft forgery high stamp duty transfer charges and loss of corporate action. Floating Rate Savings Bonds 2020 Taxable Risk free investment with good returns. All applicable charges on account of Stamp Duty MOD MOE Central Registry of Securitisation Asset Reconstruction and Security Interest of India CERSAI or such other statutory regulatory bodies and applicable taxes shall be borne and paid or refunded as the case may be solely by the customer.

As per the Indian Stamp Act 1899 stamp duty must be paid as. Whenever a property is sold or purchased in the state the buyer pays stamp duty and registration fee to the state government. Stamp duty and registration fees are a crucial part of a property transaction in Madhya Pradesh and one of the highest in the country.

Apply for auto loan online by IDFC FIRST Bank at best interest rates easy EMI option.

Zero Stamp Duty Zero Gst At Lodha Palava City Mumbai Zricks Com

Maharashtra Government Slashes Stamp Duty By 3 Until Dec 2020

Stamp Duty Calculator Calculate Stamp Duty Online

Maharashtra Govt S Decision To Reduce Stamp Duty Rates Leads To Increase In Real Estate Sale Registrations

Payment Of Stamp Duty Is No Guarantee Your Property Is Legal

Stamp Duty In Mumbai Stamp Duty And Registration Charges In Mumbai

Stamp Duty And Registration Charges In Mumbai Maharashtra

3 Bhk Apartment For Sale In Safal Parivesh Prahladnagar Ahmedabad Just 500 Mts From Corporate Road Prah Kitchen Prices Apartments For Sale Bathroom Size

Maharashtra Stamp Duty Rates Calculator Registration Charges 2021

Stamp Duty In Mumbai Stamp Duty And Registration Charges In Mumbai

Cancellation Deeds Registration Trend In Mumbai And How To Register

Maharashtra Stamp Duty Rates Calculator Registration Charges 2021

Tulsi Estates Tulsiestates Twitter

Stamp Duty And Registration Charges In India Calculation Process Hindi Youtube

Beautifully Interior Designed Fully Furnished 3 Bhk Flat Available In Resale Satellite Ahmedabad Property Resale Apartment

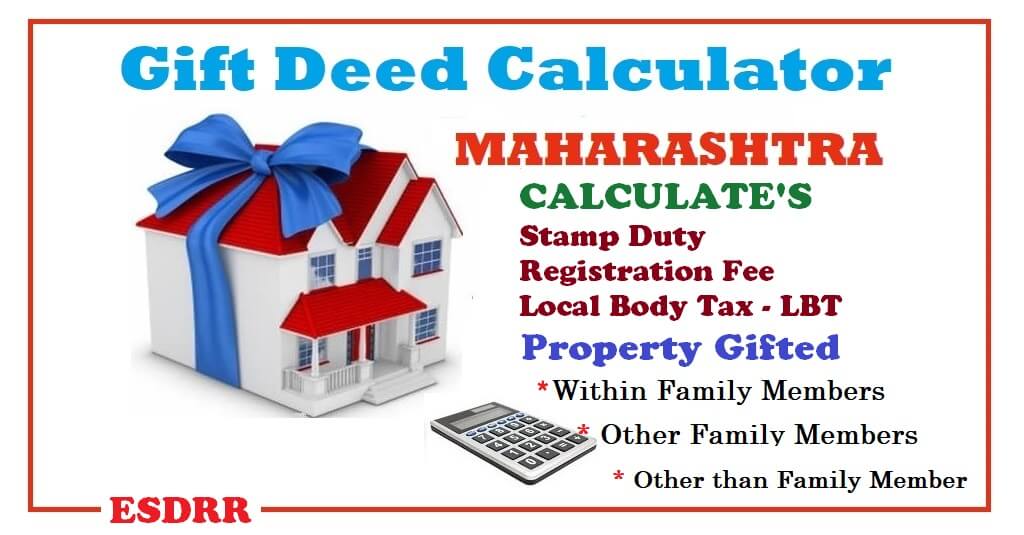

Gift Deed Stamp Duty Lbt Registration Fees 2021 Property Registration Online Consultant

2 5 Bhk Premium View Flats For Resale In The Meadows At Shantigram Nr Vaishnodevi Circle Ahmedabad The Meadows Property Car Parking

2 Bhk Lowrise Apartment For Sale At Naranpura Ahmedabad Society Bansidhar Flats Only 6 Year Old Societ Apartments For Sale Car Parking Furnished Apartment

4 Bhk High End Apartment For Sale In Friendsville Lifestyle Nr Panchvati Circle Ahmedabad Apartments For Sale Furnished Apartment Apartment

How To Register Rental Agreement Online In Maharashtra In 2021 Latest Property News Blog Articles Homebazaar Com

Stamp Duty Registration In Mumbai Raunak Group

Is There Any Alternative Of Property Registration For A Temporary Buy And Sell Quora

Stamp Duty And Registration At The Time Of Property Purchase

Maharashtra Stamp Duty Rates Calculator Registration Charges 2021

Stamp Duty And Registration Charges In Maharashtra Commonfloor Groups

What Are The Stamp Duty Registration Charges In Mumbai

How To Register Rent Agreement In Mumbai Maharashtra

Stamp Duty Cut In Maharashtra Drives Property Registration Of Over 10 000 Housing Units Worth Rs 11 000 Crore

Real Estate Offers Real Estate Development Offer Development

Charges For Stamp Duty Registration Mumbai

Calculate Stamp Duty And Registration Charges On Property

What Are The Stamp Duty Registration Charges In Mumbai

Stamp Duty In Mumbai Stamp Duty And Registration Charges In Mumbai

Stamp Duty And Registration Office In The City Thane

Charges For Stamp Duty Registration Mumbai

Ready Reckoner Mumbai Thane Palghar Raigad Pune

Shreeji Vrund Realty Pvt Ltd Home Facebook

Property In Dombivli East Near Station 2 Bhk Flat In Dombivli East Near Station Posts By Regency Group Dombivli Regency Group Station

Bhumi Jankari Minimum Value Of Land Property In Bihar For Stamp Duty Youtube

Maharashtra Stamp Duty The Latest News In Maharashtra 2020

A Guide To Stamp Duty And Registration Charges In Mumbai In 2020

Stamp Duty And Registration Charges In Kerala Kalyan Developers Blog

How To Download Agreement Index Ii Eloksevaonline

How To Check Status Of Rent Leave And License Agreement In Maharashtra Property Registration Online Consultant

2 5 Bhk Apartment For Sale In Elysium Shantigram Ahmedabad Apartments For Sale Apartment Ahmedabad

A Quick Guide On Registering Property In Navi Mumbai By Siddhivinayak Homes Issuu

3 Bhk Spacious Apartment For Resale In 31 Ivy Bodakdev Ahmedabad Resale Spacious Property

The Maharashtra Stamp Act 2020 And Stamp Duty And Registration Charges On Immovable Property

3 Bhk Highrise Apartment For Sale In Safal Parisar Ii South Bopal Ahmedabad Apartments For Sale Apartment High Rise

Up Stamp Duty Registration Online From 1 November

How To Find The Ready Reckoner Property Valuation Of Your Property In Maharashtra Youtube

Stamp Duty And Registration Charges In India Calculation Process Hindi Youtube

Stamp Duty In Housing Societies Mygate

How To Register Rent Agreement In Mumbai Maharashtra

Neptune New Prelaunch Project In Ambivali Kalyan Thane Neptune Thane Consulting Companies

Maharashtra Cuts Stamp Duty 3 Main Benefits For Homebuyers

Release Deed Registration Trend In Mumbai And How To Register One

State Govt Discontinues Stamp Duty Concession The Hitavada

Stamp Duty And Registration Charges In Mumbai Maharashtra

Stamp Duty Registration Charges In Maharastra What After March 2021

Step By Step Guide For Ec Online Telangana Certificate

Property Registration In Telangana Process Documents

Maharashtra Government Loses Rs 3885 Crore In Stamp Duty In 40 Days Of Lockdown The New Indian Express

Benefits Of Udyam Registration In 2021 Enterprise Development Registration Benefit

Charges For Stamp Duty Registration Mumbai

Charges For Stamp Duty Registration Mumbai

Gift Deed Stamp Duty And Registration Fee Calculator

Stamp Duty In Uttar Pradesh Has No Upper Cap Now Know About Latest Up Government Notification Zee Business

Stamp Duty And Registration Charges In Kanpur

How To Register Rent Agreement In Mumbai Maharashtra

What Are All The Agreements That Need Stamp Duty

Search And Download Index And Registration Documents Without Knowing Document Numer Youtube

Up Stamp Duty Registration Online From 1 November

Top 100 Stamp Duty Registration Consultants In Mumbai Best Stamp Duty Refund Consultants Justdial

Property Registration Fee Stamp Duty Charges In India 2019 2020

Stamp Duty And Registration Charges In

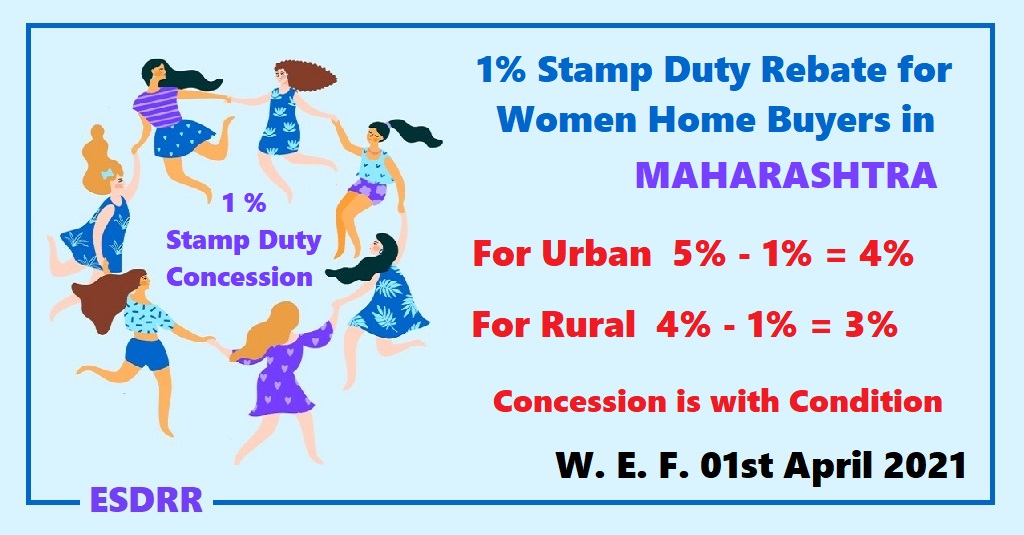

Stamp Duty Concession For Women In Maharashtra

Stamp Duty And Property Registration Charges In Ap Updated Stamp Duty Andhra Pradesh Registration

Charges For Stamp Duty Registration Mumbai

How Is Money Refunded When A Property Deal Is Cancelled Vakilsearch

Release Deed Registration Trend In Mumbai And How To Register One

Maharashtra Stamp Act Stamp Duty Refund

Maharashtra Stamp Duty Rates Calculator Registration Charges 2021

Stamp Duty And Registration Fee Calculator Mahrashtra

Aquarefeet Group 1 Down Payment Offer Ad Advert Gallery

Charges For Stamp Duty Registration Mumbai

Stamp Duty And Registration Charges In India Calculation Process Hindi Youtube

Stamp Duty Charges Online Payment Procedure In Mumbai Maharashtra

An Overview Of Stamp Duty And Registration Charges In India

Stamp Duty And Registration At The Time Of Property Purchase

Gst On Real Estate 5 On Under Construction 1 On Affordable Housing

Maharashtra Stamp Duty Rates Calculator Registration Charges 2021

2 5 Bhk Premium View Flats For Resale In The Meadows At Shantigram Nr Vaishnodevi Circle Ahmedabad The Meadows Property Car Parking

Calculate Stamp Duty And Registration Charges On Property